Your debt-to-income (DTI) ratio is one of the most important metrics lenders use to evaluate your financial health. Whether you’re applying for a mortgage, auto loan, or even a credit card, your DTI ratio plays a critical role in determining your borrowing potential. A high DTI ratio can indicate financial strain, making it harder to qualify for loans or secure favorable interest rates. On the other hand, improving your DTI ratio can increase your financial flexibility, reduce stress, and help you take full control of your financial future.

In this guide, we’ll dive into the basics of DTI, why it matters, and practical steps you can take to improve your ratio, allowing you to manage your finances better and achieve your financial goals.

What is a Debt-to-Income (DTI) Ratio?

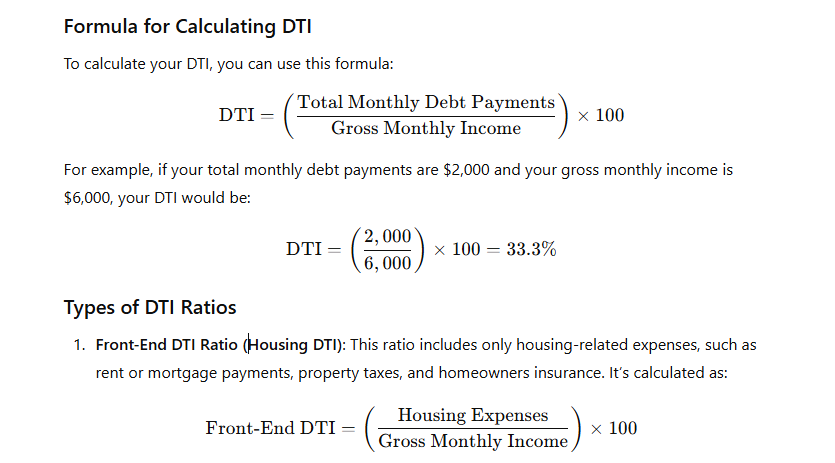

The debt-to-income ratio is the percentage of your gross monthly income that goes toward paying debts. It’s a simple but effective way for lenders to assess how much of your income is tied up in debt payments and whether you have enough remaining to cover your living expenses and financial goals.

Back-End DTI Ratio: This is the more comprehensive figure, including all monthly debt obligations, such as housing payments, credit cards, car loans, student loans, and other personal loans. It’s the figure most lenders use when determining your eligibility for loans.

Why Your DTI Ratio Matters

Lenders and financial institutions use your DTI ratio to determine your ability to manage monthly payments and repay debts. A lower DTI ratio typically indicates that you are in a better financial position, making it easier to secure financing for large purchases like homes, cars, or personal loans. On the other hand, a high DTI ratio can indicate that you are stretched thin with your finances and may have trouble making future payments.

Here’s why improving your DTI ratio is so important:

- Better Loan Terms: A lower DTI ratio means you are seen as a lower-risk borrower, which could qualify you for better interest rates and loan terms.

- Loan Approval: Many lenders have DTI threshold limits that, if exceeded, will prevent you from securing new loans. A good DTI can open doors to borrowing opportunities.

- Financial Freedom: Reducing debt can provide you with more disposable income, allowing you to save, invest, and plan for the future.

- Peace of Mind: Improving your DTI ratio can reduce stress and help you feel more in control of your finances.

Steps to Improve Your Debt-to-Income Ratio

1. Calculate Your Current DTI Ratio

Before you can take steps to improve your DTI ratio, you need to know where you stand. Calculate your DTI by adding up all your monthly debt payments and dividing that by your gross monthly income. This gives you a starting point to measure your progress. Tracking your progress is crucial for motivation and to gauge the effectiveness of the strategies you implement.

2. Increase Your Income

One of the most effective ways to improve your DTI ratio is by increasing your income. While cutting expenses can help, boosting your income gives you a more significant leverage to pay down debt.

Ways to increase your income:

- Ask for a Raise or Promotion: If you’ve been excelling in your job, it might be time to negotiate a salary increase. A higher income directly impacts your DTI ratio by providing you with more funds to pay off debt.

- Start a Side Hustle: Freelancing, consulting, or starting a small business can generate additional income. Platforms like Fiverr, Upwork, or Etsy offer opportunities to monetize skills or hobbies.

- Invest in Education and Training: Acquiring new skills or certifications can open doors to higher-paying job opportunities, helping you improve your DTI over time.

3. Pay Down Existing Debt

Reducing your overall debt is the most direct way to improve your DTI. While paying off debt might seem like an uphill battle, there are several strategies that can make the process easier and faster.

Debt Reduction Strategies:

- Debt Snowball Method: Focus on paying off the smallest debt first while making minimum payments on larger debts. Once the smallest debt is paid off, you move on to the next one. This method provides quick wins and motivates you to keep going.

- Debt Avalanche Method: Pay off high-interest debts first, which will save you more money in interest in the long run. Once high-interest debts are cleared, move on to lower-interest debts.

- Consolidate Debt: Consider consolidating high-interest debts into a single loan with a lower interest rate. This could reduce your monthly debt payments and make it easier to manage.

- Refinance Loans: If you have loans with high-interest rates (like credit cards), refinancing them at a lower rate can reduce the amount of interest you pay, which can improve your DTI ratio.

- Sell Unnecessary Assets: Consider selling assets you no longer need, such as unused electronics, jewelry, or vehicles. Use the proceeds to pay off outstanding debts.

4. Avoid Taking on More Debt

When you’re working to improve your DTI ratio, avoid taking on additional debt. This includes refraining from new credit card purchases, loans, or financing options for non-essential items. Taking on new debt will only worsen your DTI and set back your efforts to improve your financial situation.

If you need to make a large purchase, explore alternatives to debt, such as saving for the purchase over time or seeking out zero-interest financing options that won’t affect your DTI.

5. Refinance or Modify Existing Loans

Refinancing loans can lower your monthly payments, which improves your DTI. Refinancing involves replacing your current loan with a new one, typically at a lower interest rate or extended repayment term. This can be particularly beneficial for high-interest debts like credit cards or personal loans.

Another option is loan modification, which can extend the term of your loan and reduce monthly payments. This is a good option if you are struggling with your current loan terms but want to avoid taking on new debt.

6. Cut Unnecessary Expenses

Review your budget and identify areas where you can cut back. The more you can reduce your expenses, the more money you’ll have to pay down debt and improve your DTI ratio.

Some common expenses to consider reducing:

- Subscriptions: Cancel any unnecessary subscriptions, such as streaming services, magazine subscriptions, or gym memberships.

- Dining Out: Reduce dining out or takeout meals, and cook at home more often to save money.

- Utilities: Look for ways to reduce utility bills, like switching to energy-efficient appliances or cutting back on heating or cooling usage.

Redirect the money saved from cutting unnecessary expenses to pay off high-interest debt more aggressively.

7. Create a Debt Payoff Plan

Having a structured plan will help you stay on track. Set clear goals and timelines for paying off your debts. Consider automating your payments to avoid missing any due dates and to ensure you stick to your plan.

Track your progress regularly and adjust your strategy as needed. Celebrate small milestones to stay motivated throughout the process.

8. Use Windfalls Wisely

If you receive a tax refund, bonus, inheritance, or any other windfall, consider using it to pay down your debt instead of spending it. Applying these extra funds toward your debt can have an immediate and significant impact on your DTI ratio.

9. Consider Credit Counseling

If you find yourself overwhelmed by debt, it may be worthwhile to consult with a credit counselor. These professionals can help you develop a debt management plan (DMP) that consolidates your debts into a single monthly payment with lower interest rates. Credit counselors can also help you navigate your financial situation and provide advice on how to improve your DTI ratio.

Improving your debt-to-income ratio takes time and discipline, but it is a critical step in gaining financial control and increasing your borrowing capacity. By increasing your income, reducing debt, avoiding new debt, and making strategic financial choices, you can improve your DTI ratio and achieve better financial stability.

While your DTI ratio may not improve overnight, following the steps outlined in this guide will help you make steady progress toward a healthier financial future. Remember, every small action you take to reduce debt and increase your income will bring you one step closer to your financial goals.