An emergency fund is one of the most important financial tools that any family can have. It serves as a financial cushion to protect against life’s unexpected events, such as medical emergencies, job loss, or unforeseen repairs. Having a robust family emergency fund provides peace of mind, knowing that you are prepared for financial challenges without derailing your long-term financial goals.

In this article, we’ll explore the importance of an emergency fund, how much you need to save, the steps to build it, and strategies for maintaining and growing it over time.

Why Do You Need a Family Emergency Fund?

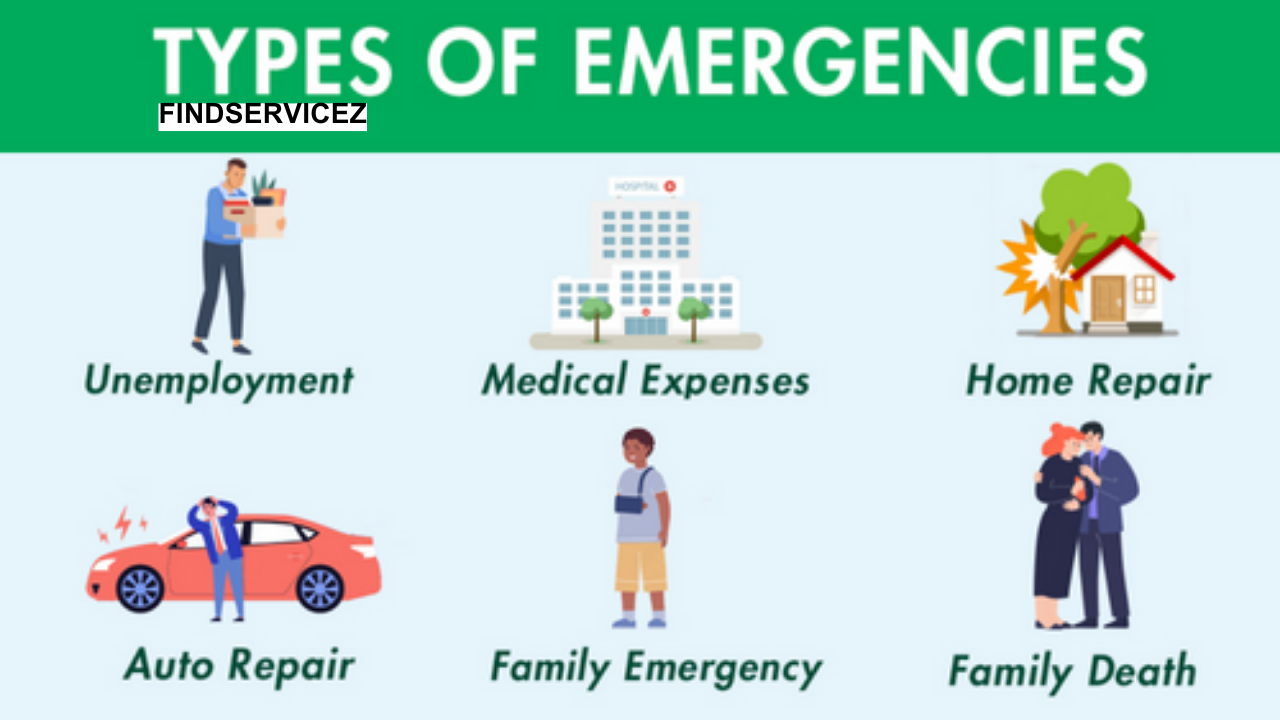

Life is unpredictable, and while we can’t always foresee what might happen, we can prepare for it. A family emergency fund is an essential part of financial security because it helps cushion the blow of an unexpected event without falling into debt. Here are some reasons why every family should prioritize building an emergency fund:

- Unpredictable Expenses: Emergencies such as car accidents, sudden illnesses, or unexpected repairs can arise at any time. These events may strain your finances if you’re not prepared.

- Job Loss or Reduced Income: Job loss is a common emergency, and having an emergency fund allows you to weather the storm while you search for new employment or adjust to a temporary reduction in income.

- Medical Emergencies: Medical bills can be overwhelming, even with insurance. An emergency fund can help cover out-of-pocket costs like co-pays, prescriptions, or treatments not covered by insurance.

- Preventing Debt: Without an emergency fund, families are often forced to use credit cards or take out loans, which can accumulate interest and result in long-term financial strain. A fund helps avoid this cycle of debt.

- Peace of Mind: Having an emergency fund reduces financial anxiety. Knowing that you can manage a crisis without resorting to drastic measures gives you peace of mind in times of uncertainty.

How Much Should You Save in Your Family Emergency Fund?

Determining how much to save is a crucial first step in building your emergency fund. Financial experts recommend saving three to six months’ worth of living expenses, but the right amount for your family depends on several factors:

- Family Size and Expenses: Consider the total monthly expenses for your family, including rent/mortgage, utilities, groceries, transportation, insurance, and other necessary bills. This will give you an idea of how much you need to cover basic expenses in case of an emergency.

- Job Stability: If your job or your spouse’s job is more stable, you may be able to get away with a smaller emergency fund. However, if either of you works in a field with high turnover or seasonal layoffs, it’s better to err on the side of caution and save more.

- Health Considerations: Families with young children, elderly parents, or members with chronic health conditions may need to save more for medical emergencies. Health-related expenses can be unpredictable and expensive, so it’s important to plan for potential medical needs.

- Debt Obligations: If you have significant debt, it’s important to consider how much you need to continue making regular payments while still managing unexpected expenses. An emergency fund ensures that you don’t have to divert funds from debt payments when an emergency occurs.

Steps to Build a Family Emergency Fund

Now that you know how much to save, let’s break down the steps to building your emergency fund:

Step 1: Set a Realistic Goal

Start by setting a clear and realistic goal for your emergency fund. This will depend on your monthly expenses and the number of months you want to cover. For example, if your monthly expenses total $3,000, a goal of $9,000 (three months of expenses) would be a good starting point.

It’s essential to set a goal that is achievable within your current financial situation. Don’t aim for an overly ambitious amount that could leave you feeling discouraged if you don’t reach it quickly.

Step 2: Open a Separate Savings Account

The next step is to open a separate savings account specifically for your emergency fund. This account should be easily accessible, but not so easily that you’re tempted to dip into it for non-emergencies.

Look for a high-yield savings account or a money market account that offers a higher interest rate than a traditional savings account. This will help your emergency fund grow over time, even as you contribute to it.

Step 3: Start Small and Be Consistent

One of the biggest obstacles to building an emergency fund is the belief that you need to start with a large sum of money. In reality, you don’t need to have a large amount upfront. Start with whatever you can afford, even if it’s as small as $25 or $50 per week.

The key is consistency. Set up automatic transfers into your emergency fund each pay period. Automating your savings ensures that you won’t skip contributions, and it allows you to steadily build your fund over time.

Step 4: Cut Unnecessary Expenses

To accelerate your savings, take a look at your monthly expenses and identify areas where you can cut back. Look for subscriptions, memberships, or discretionary spending that could be eliminated or reduced. For example, you might cancel unused streaming services or dine out less frequently.

By cutting non-essential expenses, you can increase your emergency fund contributions and reach your goal faster.

Step 5: Prioritize Saving Before Spending

Treat your emergency fund like any other monthly bill by prioritizing it before you spend on non-essential items. If necessary, adjust your lifestyle to make your emergency fund contributions a non-negotiable part of your budget.

You may need to delay certain purchases or sacrifices, but once you’ve reached your goal, the peace of mind you’ll gain will be well worth the effort.

Step 6: Use Windfalls and Bonuses

Whenever you receive unexpected money—such as tax refunds, work bonuses, or gifts—consider putting a portion of it into your emergency fund. This can give your fund a significant boost, helping you reach your goal faster.

Step 7: Monitor Your Progress

It’s important to track the progress of your emergency fund so you can stay motivated and adjust as needed. Set regular check-ins (monthly or quarterly) to review how much you’ve saved and adjust your savings plan if necessary. Monitoring your progress helps keep you on track and ensures that you stay committed to your goal.

How to Use Your Emergency Fund

Once your emergency fund is built, it’s important to understand when and how to use it. This fund should be used strictly for emergencies—unexpected events that disrupt your regular financial life. Examples of valid emergencies include:

- Medical expenses: Unforeseen medical bills, hospital stays, or urgent treatments not covered by insurance.

- Job loss or income disruption: If you or your spouse lose your job or experience a temporary reduction in income, your emergency fund can help cover living expenses until you secure new employment.

- Home or car repairs: Emergency repairs, such as a broken furnace or a car accident, that need to be addressed immediately to avoid further damage or disruption.

- Unexpected travel: Family emergencies or the need to travel for urgent matters that require immediate financial attention.

However, you should avoid using your emergency fund for non-urgent expenses, like vacations or luxury items. If you find yourself dipping into the fund frequently for non-emergencies, it may be time to reevaluate your financial priorities and habits.

Maintaining and Growing Your Emergency Fund

Once you’ve reached your goal, it’s important to maintain your emergency fund and continue to grow it over time. Here are some strategies for doing so:

- Keep It Separate: To prevent spending it on non-emergencies, keep your emergency fund in a separate account from your day-to-day spending accounts.

- Replenish After Use: If you have to dip into your emergency fund, make it a priority to replenish it as soon as possible. Set up automatic transfers to rebuild the fund back to its target amount.

- Increase the Fund Over Time: As your family’s expenses grow or as your financial situation changes, you may need to increase the amount in your emergency fund. Periodically assess your fund to ensure it still meets your needs.

- Earn More with Investments: If your emergency fund has reached the necessary threshold, consider moving excess savings into investments like low-risk bonds or index funds. This can help grow your wealth while still keeping your emergency fund liquid and safe.

Building a family emergency fund is an essential financial step that provides peace of mind in uncertain times. By setting a clear goal, automating your savings, and prioritizing your fund over time, you’ll create a financial safety net that allows your family to weather life’s storms with confidence. Remember, the key is consistency, patience, and discipline, and the reward is the ability to face emergencies without the stress of financial hardship.