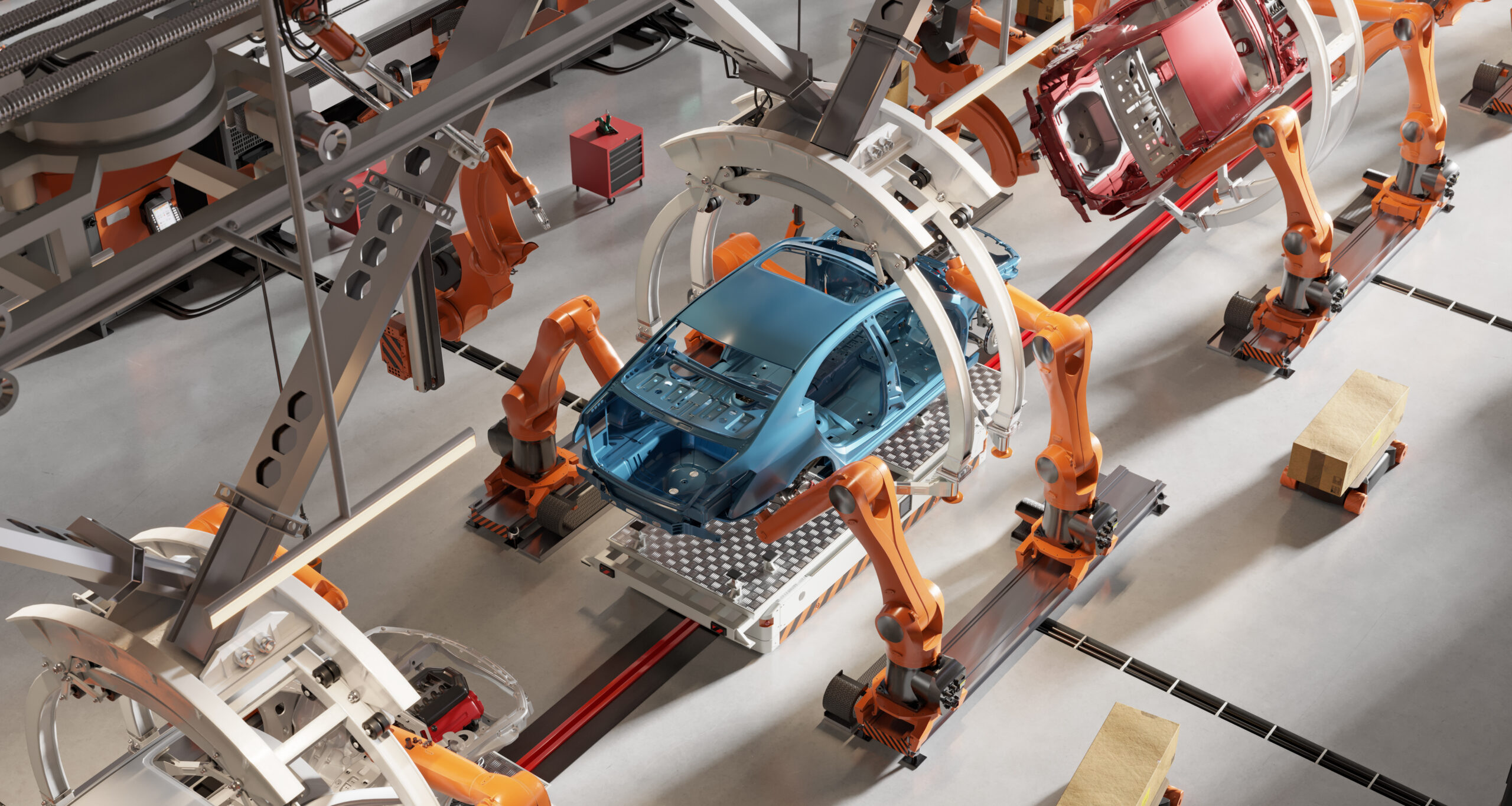

In recent years, the global automotive industry has experienced significant disruptions due to supply chain constraints, fluctuating raw material costs, and technological advancements. As a result, automotive suppliers are exploring new avenues to sustain profitability and growth. One such strategic move gaining momentum in 2025 is diversification into defense manufacturing.

With the increasing demand for advanced military technology, autonomous defense vehicles, and next-gen equipment, automotive suppliers are leveraging their expertise in precision engineering, robotics, and production efficiency to enter the lucrative defense sector. This article explores the reasons behind this transition, the benefits, challenges, and how this shift is reshaping both industries.

Why Are Automotive Suppliers Diversifying into Defense?

Why Are Automotive Suppliers Diversifying into Defense?

The automotive sector has faced slow growth rates and declining profit margins due to:

- EV transition pressures: The shift from internal combustion engines (ICEs) to electric vehicles (EVs) has forced suppliers to rethink their production strategies.

- Supply chain disruptions: Ongoing semiconductor shortages and raw material scarcities have hindered vehicle production, prompting suppliers to seek alternative revenue streams.

- Profitability challenges: With tighter margins in automotive manufacturing, the higher profitability of defense contracts offers a more stable income stream.

Key Factors Driving Diversification

Key Factors Driving Diversification

-

Rising Defense Budgets

- Global military spending is projected to reach $2.5 trillion by 2025, creating substantial opportunities for new entrants.

- Countries like the US, India, China, and European nations are significantly increasing their defense budgets due to geopolitical tensions, boosting the demand for vehicles, weapons, and defense technologies.

-

Technological Overlap

- Automotive suppliers specialize in precision engineering, autonomous systems, AI, and advanced materials, which are highly applicable to defense technologies.

- For instance:

- Autonomous military vehicles use AI navigation systems developed by automotive companies.

- Electric propulsion systems in military vehicles benefit from EV battery technology.

-

Government Incentives and Partnerships

- Governments are encouraging private automotive suppliers to collaborate with defense agencies.

- Defense procurement policies are being revised to welcome non-traditional defense contractors, making it easier for automotive suppliers to enter the sector.

Examples of Automotive Suppliers Entering Defense Manufacturing

Examples of Automotive Suppliers Entering Defense Manufacturing

1. General Motors Defense (GM Defense)

1. General Motors Defense (GM Defense)

- GM Defense, a subsidiary of General Motors, has been expanding its defense portfolio with vehicles like the Infantry Squad Vehicle (ISV).

- The ISV, based on the Chevrolet Colorado ZR2, is used by the US Army for tactical operations.

- In 2025, GM Defense is developing autonomous military vehicles and electric propulsion systems for defense applications.

2. Oshkosh Corporation

2. Oshkosh Corporation

- Originally a heavy-duty vehicle manufacturer, Oshkosh expanded into defense with its Joint Light Tactical Vehicle (JLTV) program.

- The company produces armored vehicles, tactical trucks, and autonomous defense platforms, merging its automotive and defense expertise.

3. BAE Systems and Hybrid Technologies

3. BAE Systems and Hybrid Technologies

- BAE Systems, a leading defense contractor, is collaborating with automotive battery suppliers to develop hybrid-electric combat vehicles.

- This partnership leverages automotive battery technology for military applications.

4. Tesla’s Potential Entry into Defense

4. Tesla’s Potential Entry into Defense

- Tesla’s expertise in autonomous driving, battery systems, and AI could position it to collaborate with defense agencies.

- Although speculative, defense analysts predict Tesla’s autonomous vehicle technology could be applied to unmanned military vehicles.

Technological Advancements from Automotive to Defense

Technological Advancements from Automotive to Defense

1. Autonomous and AI-Powered Defense Vehicles

1. Autonomous and AI-Powered Defense Vehicles

- Autonomous driving technology from the automotive industry is being adapted for military vehicles.

- AI-powered combat vehicles and drone logistics systems are on the rise.

- Automotive companies’ expertise in LIDAR, radar, and computer vision is being repurposed for military use.

2. Electric and Hybrid Military Vehicles

2. Electric and Hybrid Military Vehicles

- Automotive EV technologies are transforming military fleets.

- Defense forces are adopting hybrid-electric and fully electric armored vehicles to reduce fuel dependency and enhance mobility.

3. Advanced Materials and Lightweight Components

3. Advanced Materials and Lightweight Components

- Automotive suppliers’ lightweight materials, such as carbon fiber and high-strength alloys, are improving the durability and mobility of defense vehicles.

- This technology reduces vehicle weight without compromising protection.

4. Connected Defense Systems

4. Connected Defense Systems

- Automotive telematics and Internet of Things (IoT) solutions are being implemented into defense operations.

- Real-time data collection and fleet monitoring enhance battlefield logistics and vehicle efficiency.

Benefits of Automotive Suppliers in Defense Manufacturing

Benefits of Automotive Suppliers in Defense Manufacturing

1. Revenue Diversification

1. Revenue Diversification

- Defense contracts offer stable and long-term revenue, making them highly attractive during automotive sector slowdowns.

- Defense manufacturing provides higher profit margins due to specialized products and government contracts.

2. Reduced Dependency on Cyclical Automotive Market

2. Reduced Dependency on Cyclical Automotive Market

- Defense manufacturing shields suppliers from the cyclical nature of automotive sales, providing financial stability.

- During economic downturns, defense contracts act as a buffer against losses.

3. Technological Cross-Pollination

3. Technological Cross-Pollination

- Innovation in defense applications influences automotive technology development.

- AI, autonomous navigation, and battery innovations developed for military use often find their way back into civilian vehicles.

4. Enhanced Brand Reputation and Market Credibility

4. Enhanced Brand Reputation and Market Credibility

- Collaboration with defense agencies enhances brand credibility and positions suppliers as high-tech innovators.

- It opens doors for international expansion and government contracts.

Challenges Faced by Automotive Suppliers in Defense

Challenges Faced by Automotive Suppliers in Defense

1. Regulatory Compliance and Bureaucracy

1. Regulatory Compliance and Bureaucracy

- Entering defense manufacturing requires compliance with stringent regulations and security protocols.

- Suppliers must navigate ITAR (International Traffic in Arms Regulations) and complex defense export policies.

2. High Initial Investment

2. High Initial Investment

- Developing defense-grade products involves substantial R&D investments, testing, and certification processes.

- Automotive suppliers face long lead times before generating profits.

3. Competition with Established Defense Contractors

3. Competition with Established Defense Contractors

- Automotive suppliers face stiff competition from traditional defense giants like Lockheed Martin, BAE Systems, and Raytheon.

- Defense procurement agencies may prefer established names, making market penetration difficult.

Impact on the Automotive and Defense Sectors

Impact on the Automotive and Defense Sectors

For the Automotive Industry

For the Automotive Industry

- Automotive suppliers gain financial stability through defense contracts.

- The diversification fosters technological innovation, influencing the automotive sector with defense-grade advancements.

- The move reduces reliance on vehicle sales, making suppliers more resilient.

For the Defense Sector

For the Defense Sector

- Defense agencies benefit from cutting-edge automotive technologies, such as autonomous navigation and EV propulsion.

- Defense manufacturing becomes more cost-effective and efficient through automotive production techniques.

Key Global Markets for Automotive-Defense Diversification

Key Global Markets for Automotive-Defense Diversification

- United States: The US leads in defense spending, offering the largest market for defense diversification.

- Europe: The European Defense Fund (EDF) is encouraging collaboration between automotive and defense firms.

- India: With rising defense budgets, India is promoting local manufacturing under the Make in India initiative.

- China: China is investing heavily in military modernization, creating opportunities for domestic automotive suppliers.

In 2025, automotive suppliers diversifying into defense manufacturing represents a strategic shift to combat industry challenges, generate stable revenues, and drive technological innovation. This diversification allows suppliers to leverage their expertise in automation, AI, and EV technologies to meet the growing demand for next-gen defense equipment.

As governments increase defense budgets and seek advanced technological solutions, automotive suppliers are poised to become key players in the defense sector, reshaping both industries and creating new growth avenues. This trend will continue to accelerate, offering lucrative opportunities for companies that successfully navigate the transition.