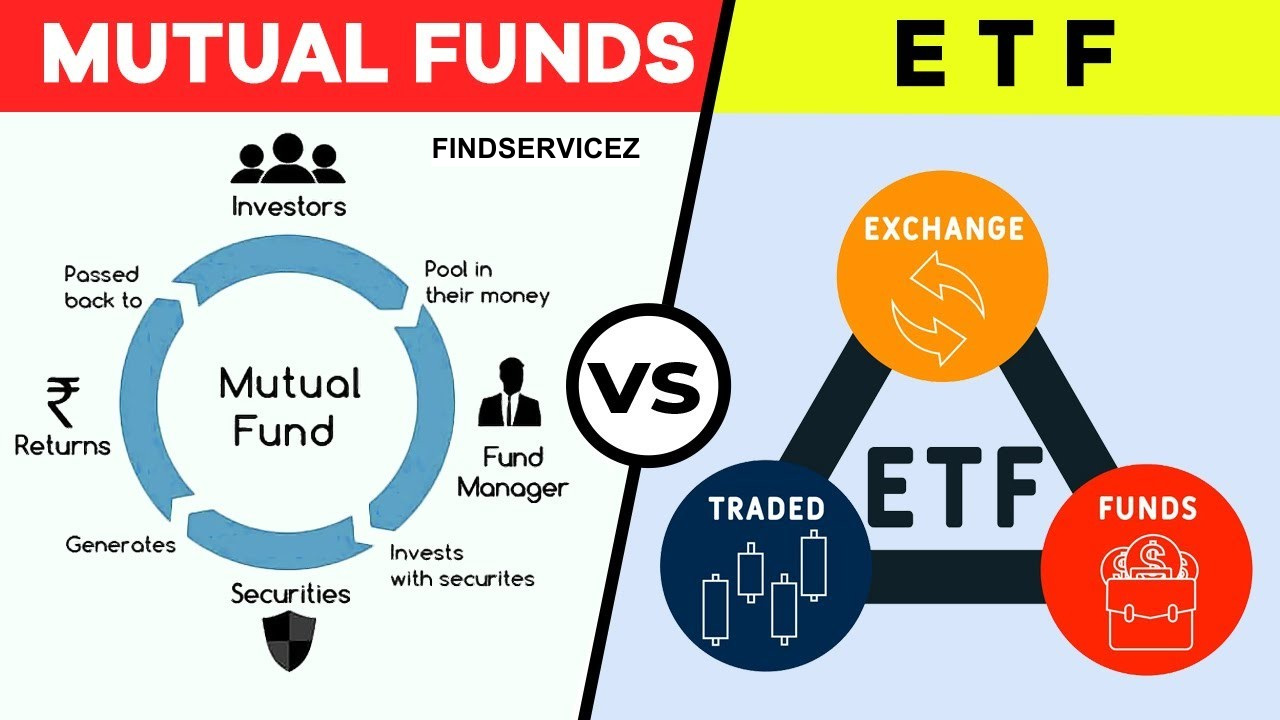

When it comes to investing, understanding the different types of investment vehicles is crucial to making informed decisions. Exchange-traded funds (ETFs) and Mutual Funds are two of the most common types of investment options, each offering distinct features, benefits, and risks. While both allow investors to diversify their portfolios by investing in a basket of assets, such as stocks, bonds, or commodities, they differ significantly in terms of structure, trading, costs, and tax implications.

This comprehensive guide will explore the key differences between ETFs and mutual funds, helping you determine which might be the better fit for your investment strategy and financial goals.

What Are ETFs (Exchange-Traded Funds)?

Definition and Overview

An Exchange-Traded Fund (ETF) is an investment fund that holds a collection of assets, such as stocks, bonds, or commodities and is traded on stock exchanges, much like individual stocks. ETFs can be passively managed, such as index funds that track the performance of a particular index (e.g., S&P 500), or actively managed, where fund managers make decisions about asset allocation.

ETFs offer investors a way to gain exposure to various sectors, industries, and markets with a single investment. They are designed to provide diversification and lower risk compared to investing in individual stocks or bonds.

Key Characteristics of ETFs

- Liquidity: ETFs are traded on exchanges, so they can be bought or sold throughout the trading day at market prices, just like stocks.

- Lower Fees: ETFs tend to have lower management fees compared to mutual funds, particularly passively managed ETFs.

- Tax Efficiency: ETFs are generally more tax-efficient due to their structure, which allows for the use of in-kind transfers, minimizing taxable events.

- Transparency: ETFs disclose their holdings daily, providing investors with full visibility of the fund’s investments.

- Flexibility: ETFs allow investors to use various trading strategies, including short-selling and margin trading.

What Are Mutual Funds?

Definition and Overview

A mutual fund is a pool of money collected from many investors to invest in a diversified portfolio of assets, such as stocks, bonds, or other securities. Mutual funds are managed by professional fund managers who make decisions about which securities to buy and sell based on the fund’s investment objective. Unlike ETFs, mutual funds are not traded on stock exchanges and can only be bought or sold at the end of the trading day at the net asset value (NAV).

Mutual funds can be actively managed, where fund managers select investments based on research and analysis, or passively managed, where the fund seeks to replicate the performance of a particular index.

Key Characteristics of Mutual Funds

- Not Traded Throughout the Day: Mutual funds are bought or sold based on the NAV, which is calculated at the end of each trading day.

- Higher Fees: Actively managed mutual funds tend to have higher management fees due to the costs associated with research, analysis, and active decision-making.

- Tax Implications: Mutual funds may be less tax-efficient due to capital gains distributions, which can occur when the fund manager buys or sells securities within the fund.

- Professional Management: Mutual funds offer investors access to professional fund managers who make investment decisions on their behalf.

- Automatic Investment and Dividends: Mutual funds often offer options for automatic investment plans and reinvestment of dividends, making them a convenient option for long-term investors.

Key Differences Between ETFs and Mutual Funds

1. Trading Mechanism

One of the most notable differences between ETFs and mutual funds is how they are bought and sold.

- ETFs: Traded on stock exchanges like stocks, ETFs can be bought or sold throughout the day at market prices, which may fluctuate during trading hours. This provides investors with flexibility in executing trades at any time during the day.

- Mutual Funds: These funds are only bought or sold at the end of the trading day. Investors submit orders during the day, but the actual transaction occurs at the NAV, which is calculated after market close.

2. Costs and Fees

The cost of investing in a fund is a critical factor in determining overall returns. Both ETFs and mutual funds have associated fees, but there are some important differences:

- ETFs: Typically have lower expense ratios, especially passive ETFs that track a specific index. However, since ETFs are traded on exchanges, investors may incur brokerage commissions when buying or selling shares, though many brokers now offer commission-free ETFs.

- Mutual Funds: Actively managed mutual funds usually have higher expense ratios due to the costs of professional management. Additionally, mutual funds may charge sales loads or other fees, although no-load funds are also available. Investors may also incur higher trading costs when buying or selling in mutual funds due to the lack of intra-day trading.

3. Diversification and Flexibility

Both ETFs and mutual funds offer diversification, but their structures provide different levels of flexibility:

- ETFs: Investors can buy and sell specific shares of ETFs throughout the trading day, making them more flexible for tactical trading or portfolio rebalancing. ETFs also allow access to specific market segments, sectors, or niche investments.

- Mutual Funds: Provide diversification through a single investment, but their lack of intra-day trading makes them less flexible. Investors typically need to wait until the end of the day for their transactions to process, which may not align with fast-moving markets.

4. Tax Efficiency

Tax efficiency is another crucial factor when deciding between ETFs and mutual funds:

- ETFs: Tend to be more tax-efficient due to their structure, which allows investors to avoid capital gains taxes unless they sell their ETF shares. This is because ETFs use an in-kind transfer process when investors redeem shares, minimizing taxable events.

- Mutual Funds: MThis maybe less tax-efficient because capital gains distributions are often triggered when the fund manager buys or sells securities. Investors who hold mutual funds in taxable accounts may face unexpected tax bills even if they haven’t sold any shares.

The Debt Snowball vs. Debt Avalanche: Which Strategy is Best?

5. Management Style

Both ETFs and mutual funds can be actively or passively managed, but the management style plays a significant role in performance:

- ETFs: While many ETFs are passively managed, tracking major indices like the S&P 500, there are also actively managed ETFs that seek to outperform the market. Passive ETFs generally have lower fees due to the lack of active management.

- Mutual Funds: These can be actively managed, with fund managers selecting securities based on their analysis and market outlook. However, actively managed funds tend to have higher fees, which can erode returns over time. Passively managed mutual funds also exist, often tracking an index like ETFs.

6. Transparency

- ETFs: Provide high transparency, as their holdings are disclosed daily. This means that investors can see exactly what securities are in the ETF at any given time.

- Mutual Funds: Typically disclose their holdings every quarter, which means investors have less real-time visibility into the fund’s portfolio.

7. Investment Minimums

- ETFs: There is no minimum investment requirement for ETFs beyond the cost of one share. This can make ETFs more accessible for investors with smaller amounts of capital.

- Mutual Funds: Many mutual funds have minimum investment requirements, which can range from a few hundred to several thousand dollars. This can be a barrier for smaller investors or those looking to invest smaller amounts.

Which Is Better for You: ETFs or Mutual Funds?

Choosing between ETFs and mutual funds depends on your investment goals, preferences, and strategy. Here are some factors to consider when making your decision:

1. Cost Sensitivity

If you are looking to minimize costs, ETFs are often the better choice due to their lower expense ratios and tax efficiency. They are particularly suitable for long-term investors who are focused on reducing fees.

2. Active vs. Passive Management

If you prefer the expertise of a professional fund manager making active investment decisions, mutual funds might be more appropriate. However, if you are comfortable with a more passive approach and want to track a specific index, ETFs are a solid option.

3. Liquidity Needs

ETFs are ideal for investors who want to trade throughout the day and react to market conditions. If you need flexibility and the ability to buy or sell at any time, ETFs are better suited to your needs. On the other hand, if you’re investing for the long term and don’t need immediate access to your funds, mutual funds could work well.

4. Tax Considerations

If tax efficiency is a major concern, ETFs are generally the better option. Their in-kind creation and redemption process helps minimize capital gains taxes, which is especially important if you are investing in taxable accounts.

5. Diversification and Strategy

Both ETFs and mutual funds provide diversification, but if you prefer a specific niche or sector focus, ETFs offer more targeted options. Mutual funds can be beneficial for those looking for professional management and are willing to pay for it.

In the battle between ETFs and mutual funds, there is no one-size-fits-all answer. Both types of investment vehicles have their strengths and weaknesses, and the right choice depends on your investment goals, strategy, and preferences. ETFs generally offer lower fees, tax efficiency, and flexibility, making them a great choice for cost-conscious, long-term investors. Mutual funds, on the other hand, provide professional management and a more hands-off approach for those who prefer active management.

Ultimately, understanding your financial situation, risk tolerance, and investment time horizon will help guide you toward the best choice for your portfolio. Whether you choose ETFs, mutual funds, or a combination of both, the key to successful investing is consistent research, diversification, and staying aligned with your long-term financial objectives.