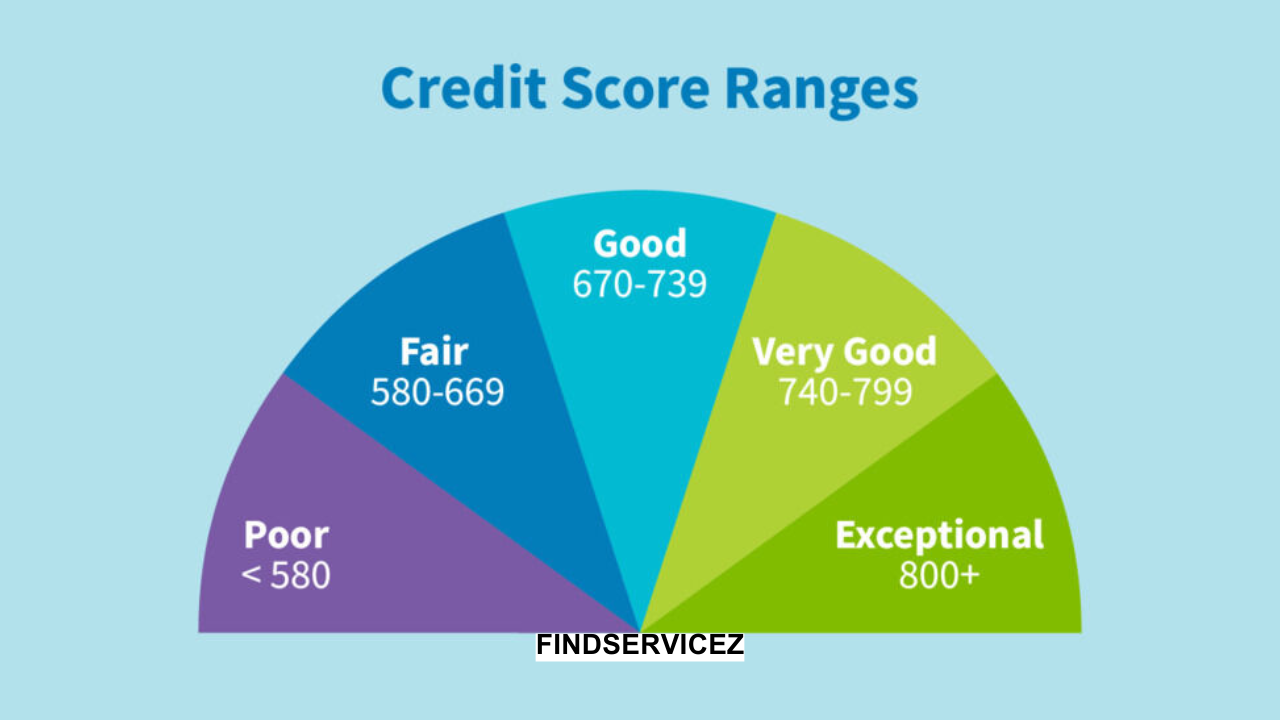

Your credit score is a crucial aspect of your financial health, influencing your ability to secure loans, obtain favorable interest rates, and even qualify for rental applications or job opportunities. Understanding what factors affect your credit score the most is essential for maintaining or improving it. This guide delves into the critical elements that determine your credit score, offering insights into how you can optimize each factor to build a robust financial profile.

1. Payment History: The Foundation of Your Credit Score

Weight on Score: 35% (for FICO scores)

Payment history is the single most significant factor affecting your credit score. Lenders rely heavily on this metric to assess the likelihood that you will repay debts on time. Late or missed payments can have a devastating impact on your score, especially if they are recent or severe.

Key Aspects of Payment History:

- On-Time Payments: Consistently paying your bills on time is critical. Even one late payment can cause your score to drop significantly.

- Severity of Late Payments: Payments that are 30, 60, or 90 days late impact your score more as the delinquency period increases.

- Public Records: Bankruptcies, foreclosures, and accounts in collections are major red flags that can remain on your credit report for years.

Tips to Improve Payment History:

- Set up automatic payments or reminders to ensure you never miss due dates.

- If you’ve missed a payment, pay it as soon as possible; the longer it goes unpaid, the greater the damage.

- Monitor your credit report for errors that might incorrectly reflect late payments.

2. Credit Utilization Ratio: Balancing Debt and Available Credit

Weight on Score: 30%

Your credit utilization ratio measures how much of your available credit you’re using. It is calculated by dividing your total credit card balances by your total credit limits. A high utilization ratio suggests a greater risk of default and can lower your credit score.

Ideal Credit Utilization:

- Experts recommend keeping your utilization ratio below 30%.

- For optimal scores, aim for a utilization ratio of 10% or less.

Example:

If you have a total credit limit of $10,000 and your balances total $3,000, your utilization ratio is 30%.

Tips to Manage Credit Utilization:

- Pay down balances to reduce your credit utilization ratio.

- Request a credit limit increase but avoid increasing spending.

- Spread balances across multiple credit cards instead of maxing out a single card.

3. Length of Credit History: Time is Your Ally

Weight on Score: 15%

The length of your credit history reflects how long you’ve been using credit. This includes the age of your oldest account, the age of your newest account, and the average age of all accounts.

Why It Matters:

- Longer credit histories provide more data for lenders to evaluate your financial behavior.

- A short credit history may lead to a lower score, even if you’ve made all payments on time.

Tips to Build Credit History:

- Avoid closing old accounts, even if you no longer use them, as they contribute to your average account age.

- Open new accounts only when necessary to avoid shortening your average credit age.

4. Credit Mix: Variety Matters

Weight on Score: 10%

A diverse mix of credit accounts demonstrates your ability to manage different types of credit responsibly. Credit mix includes:

- Revolving Credit: Credit cards.

- Installment Loans: Mortgages, auto loans, and student loans.

Why Credit Mix Matters:

- Lenders value borrowers who can handle both revolving and installment credit.

- Having only one type of credit may limit your score’s potential.

Tips to Improve Credit Mix:

- If feasible, diversify your credit portfolio by taking on a small installment loan or opening a credit card.

- Avoid taking on unnecessary debt just to diversify; this should be part of a broader financial strategy.

5. New Credit Inquiries: The Double-Edged Sword

Weight on Score: 10%

When you apply for new credit, lenders perform a hard inquiry to check your creditworthiness. While a single inquiry has a minimal impact, multiple inquiries in a short period can signal risk to lenders.

Types of Inquiries:

- Soft Inquiries: Occur when you check your own credit or when lenders pre-approve you for offers. These do not affect your score.

- Hard Inquiries: Triggered by applications for new credit and can slightly lower your score.

Key Considerations:

- Hard inquiries remain on your credit report for two years but only impact your score for the first 12 months.

- Rate shopping for loans (e.g., auto or mortgage) within a short time frame is typically treated as a single inquiry.

Tips to Manage New Credit Inquiries:

- Limit the number of credit applications you submit in a short period.

- Research loan terms in advance to minimize unnecessary hard inquiries.

- Use prequalification tools that only require soft inquiries.

6. Derogatory Marks: The Long-Lasting Impact

Derogatory marks, such as bankruptcies, charge-offs, and accounts in collections, are major factors that lower your credit score. These marks indicate severe financial distress and suggest a high risk to lenders.

Duration of Derogatory Marks:

- Late Payments: Remain on your credit report for 7 years.

- Bankruptcies: Chapter 7 bankruptcies stay for 10 years, while Chapter 13 lasts for 7 years.

- Collections: Typically reported for 7 years from the date of delinquency.

Tips to Recover from Derogatory Marks:

- Work with creditors to settle outstanding debts and request goodwill adjustments.

- Focus on building positive credit behaviors to offset negative marks.

- Regularly monitor your credit report to track the aging of derogatory items.

7. The Role of Personal Factors: Income, Employment, and Location

Although not directly factored into your credit score, personal circumstances like income, employment status, and geographic location can influence your credit decisions and financial stability.

Indirect Impacts:

- Low income may lead to higher credit utilization or difficulty paying bills.

- Frequent changes in employment could result in missed payments during transitions.

Tips to Manage Personal Factors:

- Budget carefully to live within your means and prioritize debt repayment.

- Build an emergency fund to handle income fluctuations or unexpected expenses.

8. How to Monitor and Improve Your Credit Score

Regular Credit Monitoring:

Staying informed about your credit score and report is essential. Free credit reports can be obtained annually from each of the three major credit bureaus: Experian, Equifax, and TransUnion.

Steps to Improve Your Credit Score:

- Pay Bills on Time: Prioritize timely payments to establish a strong payment history.

- Reduce Debt: Focus on paying down high balances to lower your credit utilization ratio.

- Avoid Excessive New Credit: Limit applications for new credit to maintain a stable credit profile.

- Dispute Errors: Review your credit reports for inaccuracies and dispute them promptly.

- Build Credit Wisely: Use secured credit cards or become an authorized user on someone else’s account to establish or rebuild credit.

9. The Importance of Understanding Your Credit Score

Your credit score is more than just a number—it’s a key determinant of your financial freedom. A good credit score can:

- Help you qualify for loans with better terms and lower interest rates.

- Reduce the cost of borrowing over time.

- Enhance your chances of approval for housing or employment.

Conversely, a poor credit score can limit your financial opportunities and cost you more in fees and interest payments.

Understanding the factors that affect your credit score the most empowers you to make informed financial decisions. By focusing on the primary elements—payment history, credit utilization, and the length of your credit history—you can take proactive steps to build and maintain a strong credit profile. Regular monitoring, responsible credit use, and a commitment to financial discipline are your best tools for achieving and sustaining an excellent credit score.