Retirement planning doesn’t end with accumulating savings—it’s equally critical to have a strategy for withdrawing those funds effectively. How and when you withdraw money from your retirement accounts can significantly impact the longevity of your assets and your financial well-being during retirement. A sound withdrawal strategy allows you to generate a steady income while minimizing tax burdens, investment risk, and unnecessary withdrawals. Below is a detailed guide on creating a retirement withdrawal strategy that works for your unique financial situation.

Why a Retirement Withdrawal Strategy is Important

Once you retire, your paycheck stops coming, and you rely on the assets you’ve accumulated over the years. However, without a clear strategy, it’s easy to overspend early in retirement or face higher-than-expected taxes and investment risks later in life.

A solid retirement withdrawal strategy ensures that you:

- Maximize your after-tax income.

- Avoid depleting your assets prematurely.

- Minimize the risk of outliving your savings.

- Preserve the potential for your investments to grow, even in retirement.

- Enhance peace of mind throughout your retirement years.

Step 1: Understand Your Retirement Income Sources

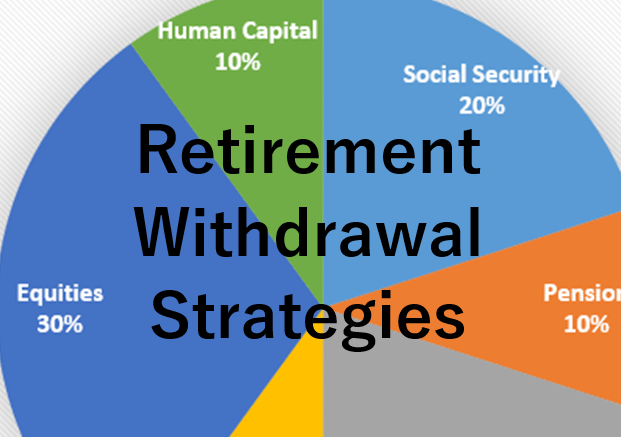

Before you begin crafting a withdrawal strategy, it’s essential to assess your retirement income sources. Retirement income can come from several places, and understanding how each fits into your strategy is the foundation for effective withdrawals.

1.1 Social Security

Social Security is often a key component of retirement income for many people. The optimal time to start taking Social Security benefits depends on factors such as your health, other income sources, and your expected longevity. You can begin drawing Social Security as early as age 62, but your benefits increase by around 8% annually until age 70. Delaying the start of benefits increases your monthly payout.

1.2 Pension Plans

If you’re fortunate enough to have a pension plan, this will also contribute to your retirement income. Pensions provide guaranteed monthly income for life and can help replace a portion of your pre-retirement salary. You should understand the payout structure, how inflation affects benefits, and whether the plan has options for survivor benefits.

1.3 Personal Savings and Investments

The majority of your retirement income will likely come from your personal savings in IRAs, 401(k)s, taxable accounts, or other investment portfolios. These funds require careful management to ensure that you can withdraw them in a way that lasts throughout retirement.

1.4 Annuities

Some retirees purchase annuities to generate a reliable stream of income. Annuities offer guaranteed monthly payouts for a fixed period or for life, but they often come with fees and limited flexibility. It’s crucial to compare annuity options to determine which best suits your needs.

1.5 Part-Time Work or Side Income

Retirement does not mean you need to stop earning altogether. Many retirees choose to work part-time or pursue hobbies that generate income. This can be a strategic way to extend the longevity of your savings while maintaining a fulfilling lifestyle.

Step 2: Calculate Your Retirement Spending Needs

Next, you need to assess how much income you’ll require in retirement. Consider your current spending habits and identify any changes that may occur once you stop working. For example, you might spend less on transportation or clothing but more on healthcare or travel.

2.1 Create a Detailed Retirement Budget

A comprehensive budget will be your guide for tracking your expenses throughout retirement. Start by breaking down your essential expenses, such as:

- Housing (rent/mortgage, utilities, insurance)

- Healthcare (premiums, out-of-pocket costs)

- Food, transportation, and taxes

Next, factor in discretionary expenses like:

- Travel and leisure activities

- Gifts and charitable donations

- Other personal goals and desires

This step will help you figure out how much you’ll need to withdraw from your savings on an annual basis to meet your financial obligations and lifestyle goals.

Step 3: Understand Your Withdrawal Options

Retirees have several methods to structure withdrawals from their accounts. Understanding the most common withdrawal strategies will help you select the one that suits your goals.

3.1 The 4% Rule

One of the most well-known retirement withdrawal strategies is the 4% rule. This rule suggests that you can safely withdraw 4% of your initial retirement portfolio per year, adjusted for inflation, and your funds should last for around 30 years. This rule is a guideline, not a hard-and-fast rule, but it can provide a solid starting point.

For example, if you have $1,000,000 in retirement savings, you can withdraw $40,000 the first year of retirement, then adjust that amount for inflation in subsequent years. However, market fluctuations, inflation, and unexpected expenses may require you to adjust your strategy.

3.2 The Bucket System

The bucket system divides your retirement savings into different “buckets,” with each bucket allocated for different time horizons. Typically:

- Bucket 1 contains liquid assets for near-term needs (1–5 years), invested in low-risk options like cash or short-term bonds.

- Bucket 2 holds medium-term assets (5–10 years), invested in balanced portfolios with a mix of stocks and bonds.

- Bucket 3 consists of long-term assets (10+ years), invested more aggressively with stocks or growth-focused mutual funds.

This strategy allows you to tap into funds from the more conservative buckets in the early years of retirement while letting the more aggressive long-term investments continue to grow.

3.3 The Required Minimum Distribution (RMD) Approach

For those with tax-deferred accounts such as 401(k)s and IRAs, you must begin taking minimum distributions at age 73 (unless you turned 72 in 2023). The IRS requires that you withdraw a minimum amount from these accounts each year, which can affect how you structure your withdrawals.

Rather than withdrawing a flat percentage, you can use the RMD amounts as a guide for how much to take from your tax-deferred accounts. The benefit is that you’re meeting tax obligations without drawing down too quickly from your retirement savings.

Step 4: Create a Tax-Efficient Withdrawal Strategy

Taxes can be one of the biggest obstacles to ensuring that your withdrawals last throughout retirement. A strategic, tax-efficient approach to withdrawals can help reduce your tax burden, leaving you with more money to spend.

4.1 Understand Different Account Taxation

Retirement accounts are taxed differently, which should be taken into account when designing a withdrawal strategy:

- Tax-deferred accounts (401(k), traditional IRA) are taxed as ordinary income when withdrawn.

- Roth IRAs and Roth 401(k)s allow for tax-free withdrawals, making them an ideal source of funds during retirement.

- Taxable accounts offer more flexibility, but the gains are taxed based on your capital gains rate.

A tax-efficient withdrawal strategy might involve withdrawing from taxable accounts first to allow your tax-deferred accounts (which grow at a slower pace) to accumulate and defer taxes longer. Roth IRAs should ideally be accessed last to take advantage of tax-free distributions.

4.2 Consider Tax Brackets

Be mindful of your tax brackets. In years when your taxable income will be lower (e.g., no pension or Social Security), you might want to take larger withdrawals from tax-deferred accounts to reduce future taxes. Conversely, you can minimize withdrawals in higher-earning years to stay within a more favorable tax bracket.

Step 5: Account for Longevity and Inflation

Longevity risk—the possibility of living longer than expected—is a key concern for retirees. Additionally, inflation can erode the purchasing power of your income over time. Here are strategies to manage these risks:

5.1 Plan for Longevity

If you are in good health and have a family history of longevity, you may want to adjust your strategy to ensure that your assets last for 30+ years. Delaying withdrawals as long as possible, optimizing Social Security, and using tools like annuities or long-term care insurance can help mitigate longevity risk.

5.2 Combat Inflation

Inflation can gradually reduce the value of your retirement income. To protect against this, consider incorporating investments that tend to grow with or above the inflation rate, such as stocks or Treasury Inflation-Protected Securities (TIPS). You can also adjust your withdrawal amount yearly for inflation, following a system similar to the 4% rule but accounting for the increased cost of living.

Step 6: Monitor and Adjust Your Withdrawal Strategy

Your retirement strategy isn’t set in stone. Over time, your financial situation, health, and goals may change, and your withdrawal strategy should evolve accordingly. Regularly review your progress and make adjustments to ensure that your withdrawals remain sustainable.

- Review your investments: Ensure your asset allocation continues to reflect your risk tolerance, investment horizon, and market conditions.

- Evaluate healthcare and long-term care costs: Keep an eye on rising healthcare costs, as they can significantly impact your retirement funds.

- Adjust withdrawals based on market performance: During market downturns, reduce withdrawals or tap into emergency savings to avoid selling investments at a loss.

Creating a retirement withdrawal strategy is a critical part of retirement planning. By understanding your income sources, accurately calculating your spending needs, exploring withdrawal methods like the 4% rule or bucket strategy, and managing taxes and investment risk, you can help ensure that your retirement savings last and that you enjoy a comfortable and financially secure retirement. Remember, flexibility and regular adjustments are key as life changes and unexpected challenges arise.