Credit cards can offer a convenient way to make purchases and manage expenses, but overusing them can lead to significant financial trouble. Whether you’ve maxed out your credit cards due to a series of unplanned expenses or have simply fallen into the habit of overspending, rebuilding your credit is possible. It will take time, discipline, and patience, but the results are worth the effort. In this guide, we’ll explore strategies to rebuild your credit after using credit cards too much.

1. Understanding Credit and Your Credit Report

Before you start rebuilding your credit, it’s important to understand how your credit works. Your credit score is a three-digit number that represents your creditworthiness to lenders and other financial institutions. This score ranges from 300 to 850, with higher scores indicating better creditworthiness.

Several factors influence your credit score, including:

- Payment History (35%): Whether you’ve paid bills on time.

- Credit Utilization (30%): The ratio of your credit card balances to their credit limits.

- Length of Credit History (15%): How long you’ve had credit accounts open.

- Types of Credit Used (10%): The variety of credit accounts, such as credit cards, mortgages, and loans.

- New Credit (10%): How often you’ve applied for new credit.

Credit Reports are documents that provide an overview of your credit history. These reports are maintained by three major credit bureaus: Equifax, Experian, and TransUnion. You can request a free credit report once every year from each of the three bureaus at AnnualCreditReport.com.

2. Assess Your Current Financial Situation

The first step in rebuilding your credit is understanding exactly where you stand. Your financial situation will guide your strategy moving forward.

- Review Your Credit Report: Request copies of your credit reports from the three major bureaus. Carefully review each report for any errors, such as incorrect late payments or accounts that don’t belong to you. If you find mistakes, dispute them with the appropriate bureau to have them corrected.

- Know Your Credit Score: Your credit score is crucial in determining your options moving forward. While the score itself doesn’t directly affect the amount of money you owe, knowing your score will help you assess how much work is needed to improve it.

- Check Your Debt-to-Income Ratio (DTI): Calculate your debt-to-income ratio by dividing your monthly debt payments by your gross monthly income. A higher ratio indicates that a significant portion of your income goes toward debt repayment, which can impact your ability to secure new credit.

3. Stop Accumulating Debt

The best way to stop worsening your credit situation is to avoid adding to your debt load. If you’ve been using credit cards too much, it’s essential to take a temporary break and control any further spending. Consider the following steps to stop accumulating debt:

- Leave Your Credit Cards at Home: Resist the temptation to continue spending, and leave your credit cards in a secure place until you’re back on track financially.

- Cut Down on Unnecessary Purchases: Create a budget to limit discretionary spending. Assess your needs versus your wants, and aim to cut out unnecessary purchases until you’re debt-free.

- Freeze or Close Accounts: If you’re not ready to fully close your credit accounts, you might consider freezing them temporarily. You can freeze your credit card with the issuer or lock your credit to prevent unauthorized activity.

4. Prioritize Paying Off High-Interest Debt

When working to rebuild your credit, paying off existing credit card balances should be your number one priority. Here’s why:

- High-Interest Debt Is Costly: Credit cards typically come with high-interest rates, sometimes exceeding 20%. The longer it takes to pay off your balance, the more you’ll pay in interest.

To tackle your credit card debt effectively:

- List All Your Debts: Organize your outstanding credit card balances by balance size, interest rate, or outstanding balance to plan your repayment strategy.

- Snowball vs. Avalanche Methods: There are two popular strategies for paying off multiple debts:

- Debt Snowball: Pay off the smallest balance first and then work your way up to the larger debts. This provides small wins that can motivate you.

- Debt Avalanche: Focus on the highest-interest debt first to minimize the total interest you’ll pay over time.

- Consider Consolidating Debt: If you have multiple credit cards with high-interest rates, you might consider consolidating your debt with a personal loan, balance transfer, or home equity loan. Consolidation may reduce the amount of interest you’re paying, making it easier to pay off your debt faster.

- Increase Your Minimum Payments: If possible, try to make payments that are more than the minimum due on each of your credit card accounts. This will help reduce both the principal and the interest more quickly.

5. Avoid Late Payments

Your payment history is the most influential factor in your credit score. Late or missed payments can have a devastating impact on your credit. Here are some strategies to avoid missing payments:

- Set Up Payment Reminders: Set reminders on your phone or computer so you never forget when a payment is due. Alternatively, enable alerts through your credit card company’s app.

- Automate Payments: Many credit card companies offer automated bill payments. Enroll in this feature to ensure that your payments are always on time.

- Settle Older Debts: If you have late payments that are lingering on your credit report, it’s essential to settle them. Reach out to creditors and negotiate payment plans or settlements to get accounts back in good standing.

- Contact Creditors for Relief: If you’re experiencing financial hardship, speak with your creditors. They may be able to offer forbearance or defer payments temporarily without impacting your credit score.

6. Lower Your Credit Utilization Ratio

Your credit utilization ratio is a significant factor in your credit score. It’s determined by the percentage of your total available credit that you’re using. A high ratio signals to lenders that you’re potentially overleveraged, which can negatively impact your score.

- Keep Balances Below 30%: Credit experts recommend using no more than 30% of your available credit. For example, if you have a $10,000 limit on your credit cards, you should aim to keep your balance below $3,000.

- Request Higher Credit Limits: If your credit card company is willing, ask for a credit limit increase. A higher limit can help lower your utilization ratio, even if you don’t increase your spending.

- Pay Balances More Than Once a Month: If you’re unable to pay off your balance in full each month, try to make multiple payments throughout the month to keep the balance lower and avoid going over the credit utilization threshold.

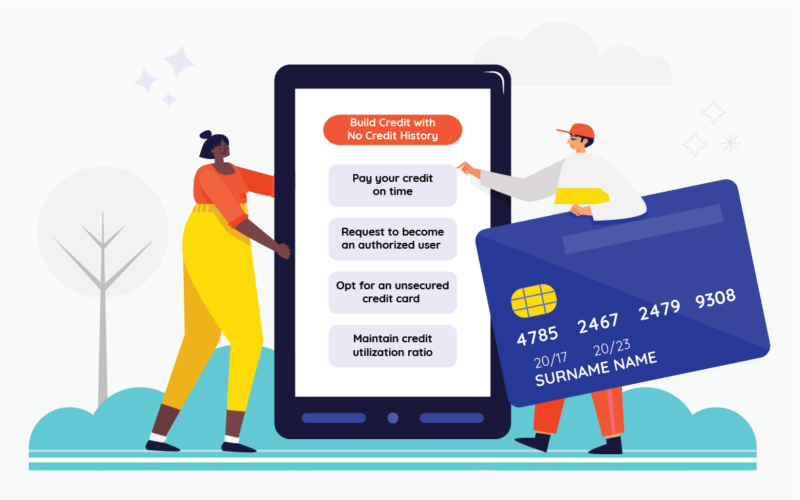

7. Consider a Secured Credit Card

If you’re having trouble qualifying for a traditional credit card after maxing out your previous ones, a secured credit card can be a useful tool to rebuild your credit.

A secured credit card requires a deposit as collateral, which becomes your credit limit. Your credit issuer reports to the credit bureaus, and your responsible use of the secured card can help improve your score over time.

To maximize the benefits:

- Pay On Time: Always make sure to pay your bill by the due date to build a positive payment history.

- Keep Utilization Low: Try to use only a small portion of your available credit and pay it off in full each month to keep your credit utilization low.

8. Check for Credit Report Errors

Sometimes, credit report errors can negatively affect your credit score. Inaccurate information—such as outdated accounts, incorrect balances, or missed payments that you didn’t make—can drag down your score unfairly.

- Dispute Any Errors: If you find incorrect information, dispute it directly with the credit bureaus. They are legally required to investigate the errors and remove them if they can’t verify them as accurate.

9. Be Patient and Stay Disciplined

Rebuilding your credit after using credit cards too much takes time. While it’s tempting to expect immediate results, credit repair is a slow process. Stick to your budget, avoid accumulating new debt, and keep up with payments. Over time, your credit score will improve as you prove that you’re a responsible borrower.

Financial Planning for Parents: Saving for College and Beyond

Rebuilding your credit after using credit cards too much can feel overwhelming, but it’s entirely possible with the right strategies. The key is to stop the cycle of overspending, make consistent, on-time payments, and be disciplined with your financial habits. By following the steps outlined above, you’ll gradually improve your credit score and regain control of your financial future. Patience, determination, and consistent effort are your best allies on this journey to financial recovery.